Page 138 - Martin Marietta - 2023 Proxy Statement

P. 138

NOTES TO FINANCIAL STATEMENTS (Continued)

Unrecognized tax benefits are reversed as a discrete event if an examination of applicable tax returns is not initiated by a federal

or state tax authority within the statute of limitations or upon effective settlement with federal or state tax authorities. For the

year ended December 31, 2022, $2.1 million was reversed into income upon the statute of limitations expiration for 2018. For the

year ended December 31, 2021, $1.6 million was reversed into income upon the statute of limitations expiration for 2017. For the

year ended December 31, 2020, $9.7 million was reversed into income upon the statute of limitations expiration for 2016 and all

prior open tax years. Management believes its accrual for unrecognized tax benefits is sufficient to cover uncertain tax positions

reviewed during audits by taxing authorities.

The Company anticipates that it is reasonably possible that its unrecognized tax benefits may decrease up to $2.0 million, excluding

interest and correlative effects, during the twelve months ending December 31, 2023, due to the expiration of the statutes of

limitations for the 2019 tax year.

The Company’s tax years subject to federal, state or foreign examinations are 2018 through 2022.

Note K: Retirement Plans, Postretirement and Postemployment Benefits

he Company sponsors defined benefit retirement plans that cover substantially all employees. Additionally, the Company

provides other postretirement benefits for certain employees, including medical benefits for retirees and their spouses and retiree

life insurance. Employees starting on or after January 1, 2002 are not eligible for postretirement welfare plans. The Company also

provides certain benefits, such as disability benefits, to former or inactive employees after employment but before retirement.

The measurement date for the Company’s defined benefit plans, postretirement benefit plans and postemployment benefit plans

is December 31. During 2022, the Company amended its qualified pension plan to provide an enhanced benefit for eligible hourly

active participants who retire subsequent to April 30, 2022, which resulted in a remeasurement of the qualified pension plan as of

February 28, 2022. The remeasurement increased the defined benefit plans’ unrecognized prior service cost by $47.6 million.

Defined Benefit Retirement Plans. Defined retirement benefits for salaried employees are based on each employee’s years of

service and average compensation for a specified period of time before retirement. Defined retirement benefits for hourly

employees are generally stated amounts for specified periods of service.

The Company sponsors a Supplemental Excess Retirement Plan (SERP) that generally provides for the payment of retirement

benefits in excess of allowable Internal Revenue Code limits. The SERP generally provides for a lump‐sum payment of vested

benefits. When these benefit payments exceed the sum of the service and interest costs for the SERP during a year, the Company

recognizes a pro rata portion of the SERP’s unrecognized actuarial loss as settlement expense.

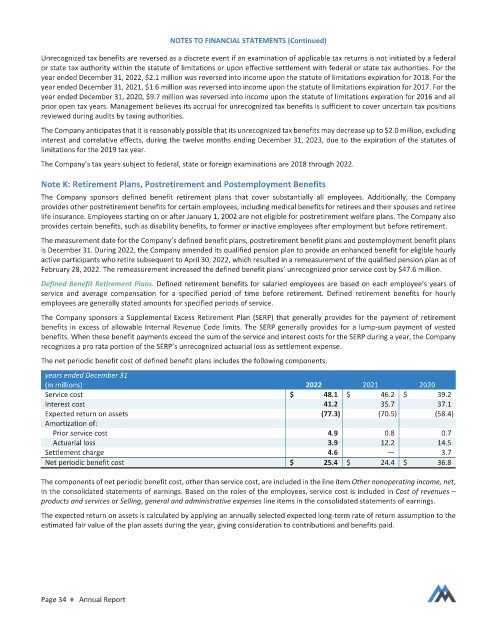

The net periodic benefit cost of defined benefit plans includes the following components:

years ended December 31

(in millions) 2022 2021 2020

Service cost $ 48.1 $ 46.2 $ 39.2

Interest cost 41.2 35.7 37.1

Expected return on assets (77.3) (70.5) (58.4)

Amortization of:

Prior service cost 4.9 0.8 0.7

Actuarial loss 3.9 12.2 14.5

Settlement charge 4.6 — 3.7

Net periodic benefit cost $ 25.4 $ 24.4 $ 36.8

e

The components of net periodic benefit cost, other than service cost, are included in the line item Other nonoperating income, net,

C

C

in the consolidated statements of earnings. Based on the roles of the employees, service cost is included in Cost of revenues –

o

i

products and services or Selling, general and adminisi trative expx enses line items in the consolidated statements of earnings.

t

t

The expected return on assets is calculated by applying an annually selected expected long‐term rate of return assumption to the

estimated fair value of the plan assets during the year, giving consideration to contributions and benefits paid.

Page 34 ♦ Annual Report