Page 133 - Martin Marietta - 2023 Proxy Statement

P. 133

NOTES TO FINANCIAL STATEMENTS (Continued)

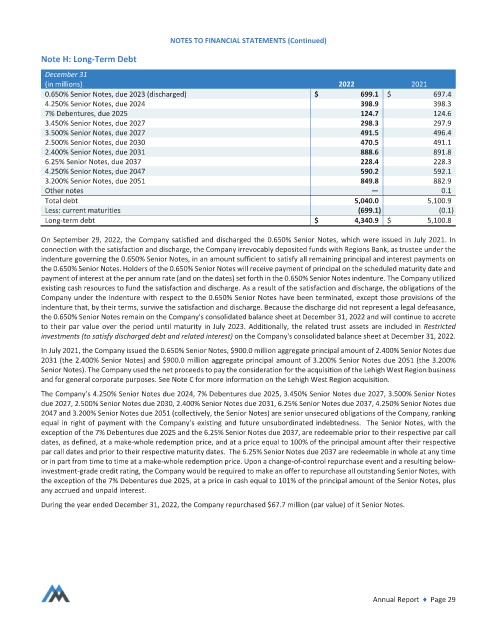

Note H: Long‐Term Debt

December 31

(in millions) 2022 2021

0.650% Senior Notes, due 2023 (discharged) $ 699.1 $ 697.4

4.250% Senior Notes, due 2024 398.9 398.3

7% Debentures, due 2025 124.7 124.6

3.450% Senior Notes, due 2027 298.3 297.9

3.500% Senior Notes, due 2027 491.5 496.4

2.500% Senior Notes, due 2030 470.5 491.1

2.400% Senior Notes, due 2031 888.6 891.8

6.25% Senior Notes, due 2037 228.4 228.3

4.250% Senior Notes, due 2047 590.2 592.1

3.200% Senior Notes, due 2051 849.8 882.9

Other notes — 0.1

Total debt 5,040.0 5,100.9

Less: current maturities (699.1) (0.1)

Long‐term debt $ 4,340.9 $ 5,100.8

On September 29, 2022, the Company satisfied and discharged the 0.650% Senior Notes, which were issued in July 2021. In

connection with the satisfaction and discharge, the Company irrevocably deposited funds with Regions Bank, as trustee under the

indenture governing the 0.650% Senior Notes, in an amount sufficient to satisfy all remaining principal and interest payments on

the 0.650% Senior Notes. Holders of the 0.650% Senior Notes will receive payment of principal on the scheduled maturity date and

payment of interest at the per annum rate (and on the dates) set forth in the 0.650% Senior Notes indenture. The Company utilized

existing cash resources to fund the satisfaction and discharge. As a result of the satisfaction and discharge, the obligations of the

Company under the indenture with respect to the 0.650% Senior Notes have been terminated, except those provisions of the

indenture that, by their terms, survive the satisfaction and discharge. Because the discharge did not represent a legal defeasance,

the 0.650% Senior Notes remain on the Company's consolidated balance sheet at December 31, 2022 and will continue to accrete

to their par value over the period until maturity in July 2023. Additionally, the related trust assets are included in Restricted

investments (to satisi fs yf disi charged debt and related interest)t on the Company's consolidated balance sheet at December 31, 2022.

t

i

t

f

i

In July 2021, the Company issued the 0.650% Senior Notes, $900.0 million aggregate principal amount of 2.400% Senior Notes due

2031 (the 2.400% Senior Notes) and $900.0 million aggregate principal amount of 3.200% Senior Notes due 2051 (the 3.200%

Senior Notes). The Company used the net proceeds to pay the consideration for the acquisition of the Lehigh West Region business

and for general corporate purposes. See Note Cfor more information on the Lehigh West Region acquisition.

The Company’s 4.250% Senior Notes due 2024, 7% Debentures due 2025, 3.450% Senior Notes due 2027, 3.500% Senior Notes

due 2027, 2.500% Senior Notes due 2030, 2.400% Senior Notes due 2031, 6.25% Senior Notes due 2037, 4.250% Senior Notes due

2047 and 3.200% Senior Notes due 2051 (collectively, the Senior Notes) are senior unsecured obligations of the Company, ranking

equal in right of payment with the Company’s existing and future unsubordinated indebtedness. The Senior Notes, with the

exception of the 7% Debentures due 2025 and the 6.25% Senior Notes due 2037, are redeemable prior to their respective par call

dates, as defined, at a make‐whole redemption price, and at a price equal to 100% of the principal amount after their respective

par call dates and prior to their respective maturity dates. The 6.25% Senior Notes due 2037 are redeemable in whole at any time

or in part from time to time at a make‐whole redemption price. Upon a change‐of‐control repurchase event and a resulting below‐

investment‐grade credit rating, the Company would be required to make an offer to repurchase all outstanding Senior Notes, with

the exception of the 7% Debentures due 2025, at a price in cash equal to 101% of the principal amount of the Senior Notes, plus

any accrued and unpaid interest.

During the year ended December 31, 2022, the Company repurchased $67.7 million (par value) of it Senior Notes.

Annual Report ♦ Page 29