Page 135 - Martin Marietta - 2023 Proxy Statement

P. 135

NOTES TO FINANCIAL STATEMENTS (Continued)

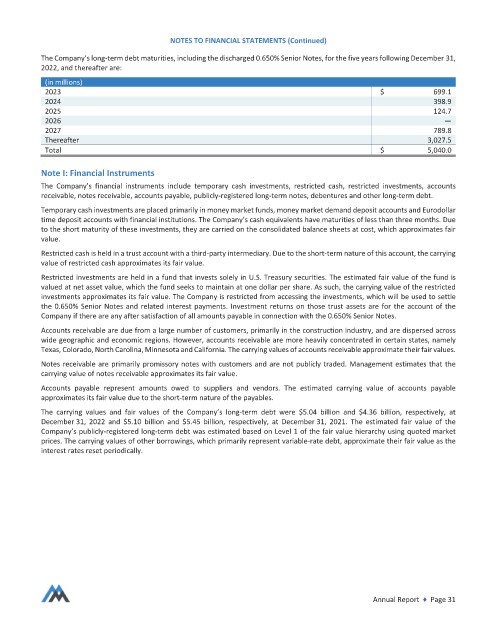

The Company’s long‐term debt maturities, including the discharged 0.650% Senior Notes, for the five years following December 31,

2022, and thereafter are:

(in millions)

2023 $ 699.1

2024 398.9

2025 124.7

2026 —

2027 789.8

Thereafter 3,027.5

Total $ 5,040.0

Note I: Financial Instruments

The Company’s financial instruments include temporary cash investments, restricted cash, restricted investments, accounts

receivable, notes receivable, accounts payable, publicly‐registered long‐term notes, debentures and other long‐term debt.

Temporary cash investments are placed primarily in money market funds, money market demand deposit accounts and Eurodollar

time deposit accounts with financial institutions. The Company’s cash equivalents have maturities of less than three months. Due

to the short maturity of these investments, they are carried on the consolidated balance sheets at cost, which approximates fair

value.

Restricted cash is held in a trust account with a third‐party intermediary. Due to the short‐term nature of this account, the carrying

value of restricted cash approximates its fair value.

Restricted investments are held in a fund that invests solely in U.S. Treasury securities. The estimated fair value of the fund is

valued at net asset value, which the fund seeks to maintain at one dollar per share. As such, the carrying value of the restricted

investments approximates its fair value. The Company is restricted from accessing the investments, which will be used to settle

the 0.650% Senior Notes and related interest payments. Investment returns on those trust assets are for the account of the

Company if there are any after satisfaction of all amounts payable in connection with the 0.650% Senior Notes.

Accounts receivable are due from a large number of customers, primarily in the construction industry, and are dispersed across

wide geographic and economic regions. However, accounts receivable are more heavily concentrated in certain states, namely

Texas, Colorado, North Carolina, Minnesota and California. The carrying values of accounts receivable approximate their fair values.

Notes receivable are primarily promissory notes with customers and are not publicly traded. Management estimates that the

carrying value of notes receivable approximates its fair value.

Accounts payable represent amounts owed to suppliers and vendors. The estimated carrying value of accounts payable

approximates its fair value due to the short‐term nature of the payables.

The carrying values and fair values of the Company’s long‐term debt were $5.04 billion and $4.36 billion, respectively, at

December 31, 2022 and $5.10 billion and $5.45 billion, respectively, at December 31, 2021. The estimated fair value of the

Company’s publicly‐registered long‐term debt was estimated based on Level 1 of the fair value hierarchy using quoted market

prices. The carrying values of other borrowings, which primarily represent variable‐rate debt, approximate their fair value as the

interest rates reset periodically.

Annual Report ♦ Page 31