Page 51 - Martin Marietta - 2023 Proxy Statement

P. 51

Summary of Our Compensation Considerations

Overall, the Company had another exceptional year, realizing record financial results, achieving world-class safety incident

rates and, making significant progress on our long-term strategic plan. This CD&A describes how our executive

compensation philosophy and the pay programs applicable to our NEOs in 2022 help to drive our strategy and

performance. The fundamental objectives of our executive compensation program are to motivate our executive team,

align pay with performance, attract and retain high-performing talent, and drive shareholder value. These objectives were

achieved in 2022 as our incentive programs paid out commensurate with our strong performance. The compensation

programs described below have been developed and are overseen by the Committee to promote the achievement of these

objectives and reflect the considerations described below.

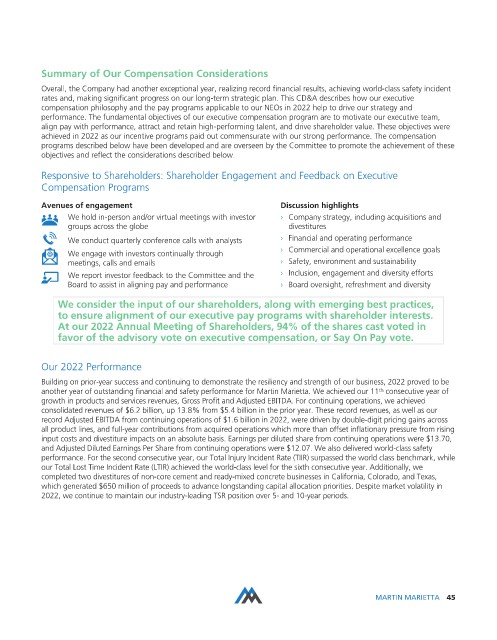

Responsive to Shareholders: Shareholder Engagement and Feedback on Executive

Compensation Programs

Avenues of engagement Discussion highlights

We hold in-person and/or virtual meetings with investor › Company strategy, including acquisitions and

groups across the globe divestitures

We conduct quarterly conference calls with analysts › Financial and operating performance

› Commercial and operational excellence goals

We engage with investors continually through

meetings, calls and emails › Safety, environment and sustainability

We report investor feedback to the Committee and the › Inclusion, engagement and diversity efforts

Board to assist in aligning pay and performance › Board oversight, refreshment and diversity

We consider the input of our shareholders, along with emerging best practices,

to ensure alignment of our executive pay programs with shareholder interests.

At our 2022 Annual Meeting of Shareholders, 94% of the shares cast voted in

favor of the advisory vote on executive compensation, or Say On Pay vote.

Our 2022 Performance

Building on prior-year success and continuing to demonstrate the resiliency and strength of our business, 2022 proved to be

another year of outstanding financial and safety performance for Martin Marietta. We achieved our 11 consecutive year of

th

growth in products and services revenues, Gross Profit and Adjusted EBITDA. For continuing operations, we achieved

consolidated revenues of $6.2 billion, up 13.8% from $5.4 billion in the prior year. These record revenues, as well as our

record Adjusted EBITDA from continuing operations of $1.6 billion in 2022, were driven by double-digit pricing gains across

all product lines, and full-year contributions from acquired operations which more than offset inflationary pressure from rising

input costs and divestiture impacts on an absolute basis. Earnings per diluted share from continuing operations were $13.70,

and Adjusted Diluted Earnings Per Share from continuing operations were $12.07. We also delivered world-class safety

performance. For the second consecutive year, our Total Injury Incident Rate (TIIR) surpassed the world class benchmark, while

our Total Lost Time Incident Rate (LTIR) achieved the world-class level for the sixth consecutive year. Additionally, we

completed two divestitures of non-core cement and ready-mixed concrete businesses in California, Colorado, and Texas,

which generated $650 million of proceeds to advance longstanding capital allocation priorities. Despite market volatility in

2022, we continue to maintain our industry-leading TSR position over 5- and 10-year periods.

MARTIN MARIETTA 45