Page 61 - Martin Marietta - 2021 Proxy Statement

P. 61

COMPENSATION DISCUSSION AND ANALYSIS / SELECTION OF RELATIVE TSR

We believe that EBITDA, Sales Growth and rTSR metrics drive the behaviors of our management team in ways that are

intended to create the most value for our shareholders.

Performance-Based RSU Awards (45% of LTI Award)

RSUs vest in three equal portions, each on the anniversary of the grant date (February 19, 2020) over a period of three

years, subject to satisfaction of the performance measure and generally to continued employment through each one of

those anniversaries. Once the restricted period ends (each anniversary for one third of the total RSU award), the recipient

will be issued unrestricted shares of common stock (minus applicable taxes). The 2020 RSUs awarded to executive officers

are also subject to a performance measure that a stated level of EBITDA be achieved during the first year. If the

performance measure is satisfied, then the RSUs will continue to vest. If the performance measure is not satisfied, then the

RSUs will be forfeited. For the 2020 grants, the performance measure was satisfied.

2020-2022 Performance Goals

In setting minimum and maximum levels of payment, we reviewed historical levels of performance against our long-range

plan commitments and conducted sensitivity analyses on alternative outcomes focused on identifying likely minimum and

maximum boundary performance levels. Levels between 100% and the minimum and maximum levels were derived using

linear interpolation between the performance hurdles.

The specific EBITDA and Sales Growth target values for the 2020-2022 PSUs are not publicly disclosed at the time of grant

due to the proprietary nature and competitive sensitivity of the information. However, the method used to calculate the

awards will be based on actual performance compared to our 2020-2022 targets, with straight-line interpolation between

points. The individual award agreements require the adjustment of goals to ensure that the ultimate payouts are not

impacted to the benefit or detriment of management by specified events, such as unplanned pension contributions,

changes in accounting (GAAP) standards or impact of an acquisition or divestiture. The Committee may exercise its

discretion to reduce the final vesting percentage to no more than target if the Company’s three-year TSR is less than zero.

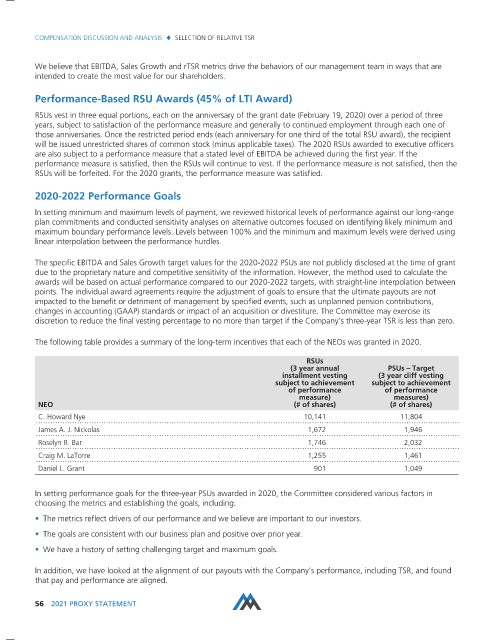

The following table provides a summary of the long-term incentives that each of the NEOs was granted in 2020.

RSUs

(3 year annual PSUs – Target

installment vesting (3 year cliff vesting

subject to achievement subject to achievement

of performance of performance

measure) measures)

NEO (# of shares) (# of shares)

C. Howard Nye 10,141 11,804

James A. J. Nickolas 1,672 1,946

Roselyn R. Bar 1,746 2,032

Craig M. LaTorre 1,255 1,461

Daniel L. Grant 901 1,049

In setting performance goals for the three-year PSUs awarded in 2020, the Committee considered various factors in

choosing the metrics and establishing the goals, including:

• The metrics reflect drivers of our performance and we believe are important to our investors.

• The goals are consistent with our business plan and positive over prior year.

• We have a history of setting challenging target and maximum goals.

In addition, we have looked at the alignment of our payouts with the Company’s performance, including TSR, and found

that pay and performance are aligned.

56 2021 PROXY STATEMENT