Page 59 - Martin Marietta - 2021 Proxy Statement

P. 59

COMPENSATION DISCUSSION AND ANALYSIS / ANNUAL INCENTIVE FEATURE: STOCK PURCHASE PLAN

Annual Incentive Feature: Stock Purchase Plan

The Incentive Stock Plan further promotes the alignment of executive compensation levels with our investors’ financial

interests by requiring that a portion of the annual bonus award be deferred into Company stock units that vest based on

continued service. Executive officers can also elect to defer amounts above the mandatory deferral amount. The voluntary

election allows executives to invest up to 50% of their annual cash incentive compensation to purchase units that are

subsequently converted into shares of common stock pursuant to the terms of the plan at a 20% discount from the

market price of Martin Marietta’s common stock on the date the amount of the incentive compensation is determined.

The discount is used to account for the risk of trading current cash compensation for “at-risk” shares which may decline in

value.

The mandatory portion requires executives to invest a minimum of 20% of their cash incentive compensation towards the

crediting of units under the plan. The CEO is required to invest a minimum of 35% of his cash incentive compensation

towards the crediting of such units.

The units generally vest in three years from the date of the award and are distributed in shares of common stock. If an

executive officer voluntarily terminates employment before the units vest, the stock units are forfeited and the executive

officer receives a cash payment equal to the lesser of the cash that was invested or the fair value of the share units on the

day of termination. Mr. Nye deferred the maximum of 50% of his 2020 cash bonus in stock units.

The mandatory contribution requirement directly links a portion of executive officer compensation to shareholder returns.

The vesting aspect, combined with the yearly stock purchase requirement, creates continuous overlapping three-year

cycles, which encourage executive officer retention and provide a continuous link of a significant portion of executive

officer compensation with shareholder return over the long-term to reward these executive officers in line with our

shareholders when our stock price increases.

2020 Long-Term Incentive Compensation Overview

Our LTI plan’s design reflects the objectives of our compensation program and is in-line with current market approaches,

based on the advice of the Committee’s independent compensation consultant. Our plan design objectives are a simplified

LTI program that is transparent and enhances the line of sight between our performance and compensation.

The award in 2020 for all NEOs was determined as a fixed percentage of base salary with some variation for position and

grade, which amount was converted into common stock units based on the average Martin Marietta stock price for the

20-day period ending on February 19, 2020, the day the Martin Marietta Board of Directors confirmed the award, or

$266.2545. This award value was then divided into PSUs and performance-based RSUs, with 55% of the total award for

NEOs consisting of the PSUs at target level and 45% of the total award for NEOs consisting of performance-based RSUs.

The Committee believes that the incentive mix (PSUs and performance-based RSUs) constitutes an appropriate pay process

and streamlined plan, which more fully reflects the performance of the Company and is better aligned with each NEO’s

role within Martin Marietta. See a further description under Outstanding Equity Awards at Fiscal Year-End and

corresponding footnotes on page 68.

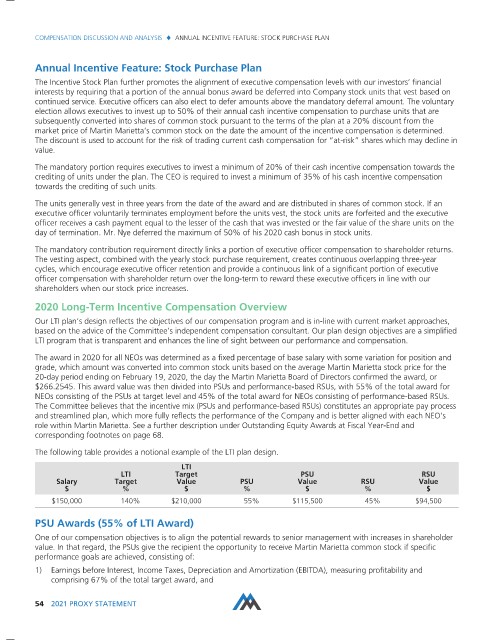

The following table provides a notional example of the LTI plan design.

LTI

LTI Target PSU RSU

Salary Target Value PSU Value RSU Value

$ % $ % $ % $

$150,000 140% $210,000 55% $115,500 45% $94,500

PSU Awards (55% of LTI Award)

One of our compensation objectives is to align the potential rewards to senior management with increases in shareholder

value. In that regard, the PSUs give the recipient the opportunity to receive Martin Marietta common stock if specific

performance goals are achieved, consisting of:

1) Earnings before Interest, Income Taxes, Depreciation and Amortization (EBITDA), measuring profitability and

comprising 67% of the total target award, and

54 2021 PROXY STATEMENT