Page 40 - 2019 Annual Report

P. 40

NOTES TO FINANCIAL STATEMENTS (continued)

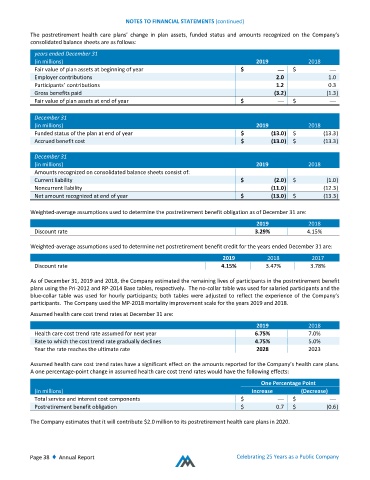

The postretirement health care plans’ change in plan assets, funded status and amounts recognized on the Company’s

consolidated balance sheets are as follows:

years ended December 31

(in millions) 2019 2018

Fair value of plan assets at beginning of year $ — $ —

Employer contributions 2.0 1.0

Participants’ contributions 1.2 0.3

Gross benefits paid (3.2 ) (1.3 )

Fair value of plan assets at end of year $ — $ —

December 31

(in millions) 2019 2018

Funded status of the plan at end of year $ (13.0 ) $ (13.3 )

Accrued benefit cost $ (13.0 ) $ (13.3 )

December 31

(in millions) 2019 2018

Amounts recognized on consolidated balance sheets consist of:

Current liability $ (2.0 ) $ (1.0 )

Noncurrent liability (11.0 ) (12.3 )

Net amount recognized at end of year $ (13.0 ) $ (13.3 )

Weighted‐average assumptions used to determine the postretirement benefit obligation as of December 31 are:

2019 2018

Discount rate 3.29% 4.15%

Weighted‐average assumptions used to determine net postretirement benefit credit for the years ended December 31 are:

2019 2018 2017

Discount rate 4.15% 3.47% 3.78%

As of December 31, 2019 and 2018, the Company estimated the remaining lives of participants in the postretirement benefit

plans using the Pri‐2012 and RP‐2014 Base tables, respectively. The no‐collar table was used for salaried participants and the

blue‐collar table was used for hourly participants; both tables were adjusted to reflect the experience of the Company’s

participants. The Company used the MP‐2018 mortality improvement scale for the years 2019 and 2018.

Assumed health care cost trend rates at December 31 are:

2019 2018

Health care cost trend rate assumed for next year 6.75% 7.0%

Rate to which the cost trend rate gradually declines 4.75% 5.0%

Year the rate reaches the ultimate rate 2028 2023

Assumed health care cost trend rates have a significant effect on the amounts reported for the Company’s health care plans.

A one percentage‐point change in assumed health care cost trend rates would have the following effects:

One Percentage Point

(in millions) Increase (Decrease)

Total service and interest cost components $ — $ —

Postretirement benefit obligation $ 0.7 $ (0.6 )

The Company estimates that it will contribute $2.0 million to its postretirement health care plans in 2020.

Page 38 ♦ Annual Report Celebrating 25 Years as a Public Company