Page 74 - Martin Marietta - 2021 Proxy Statement

P. 74

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END / EXECUTIVE COMPENSATION

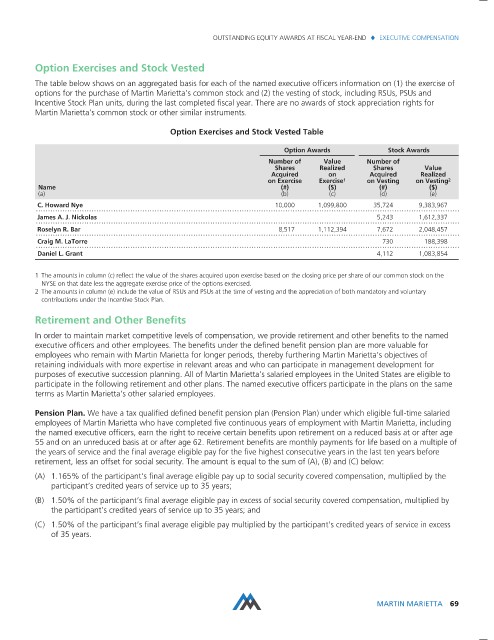

Option Exercises and Stock Vested

The table below shows on an aggregated basis for each of the named executive officers information on (1) the exercise of

options for the purchase of Martin Marietta’s common stock and (2) the vesting of stock, including RSUs, PSUs and

Incentive Stock Plan units, during the last completed fiscal year. There are no awards of stock appreciation rights for

Martin Marietta’s common stock or other similar instruments.

Option Exercises and Stock Vested Table

Option Awards Stock Awards

Number of Value Number of

Shares Realized Shares Value

Acquired on Acquired Realized

on Exercise Exercise 1 on Vesting on Vesting 2

Name (#) ($) (#) ($)

(a) (b) (c) (d) (e)

C. Howard Nye 10,000 1,099,800 35,724 9,383,967

James A. J. Nickolas 5,243 1,612,337

Roselyn R. Bar 8,517 1,112,394 7,672 2,048,457

Craig M. LaTorre 730 188,398

Daniel L. Grant 4,112 1,083,854

1 The amounts in column (c) reflect the value of the shares acquired upon exercise based on the closing price per share of our common stock on the

NYSE on that date less the aggregate exercise price of the options exercised.

2 The amounts in column (e) include the value of RSUs and PSUs at the time of vesting and the appreciation of both mandatory and voluntary

contributions under the Incentive Stock Plan.

Retirement and Other Benefits

In order to maintain market competitive levels of compensation, we provide retirement and other benefits to the named

executive officers and other employees. The benefits under the defined benefit pension plan are more valuable for

employees who remain with Martin Marietta for longer periods, thereby furthering Martin Marietta’s objectives of

retaining individuals with more expertise in relevant areas and who can participate in management development for

purposes of executive succession planning. All of Martin Marietta’s salaried employees in the United States are eligible to

participate in the following retirement and other plans. The named executive officers participate in the plans on the same

terms as Martin Marietta’s other salaried employees.

Pension Plan. We have a tax qualified defined benefit pension plan (Pension Plan) under which eligible full-time salaried

employees of Martin Marietta who have completed five continuous years of employment with Martin Marietta, including

the named executive officers, earn the right to receive certain benefits upon retirement on a reduced basis at or after age

55 and on an unreduced basis at or after age 62. Retirement benefits are monthly payments for life based on a multiple of

the years of service and the final average eligible pay for the five highest consecutive years in the last ten years before

retirement, less an offset for social security. The amount is equal to the sum of (A), (B) and (C) below:

(A) 1.165% of the participant’s final average eligible pay up to social security covered compensation, multiplied by the

participant’s credited years of service up to 35 years;

(B) 1.50% of the participant’s final average eligible pay in excess of social security covered compensation, multiplied by

the participant’s credited years of service up to 35 years; and

(C) 1.50% of the participant’s final average eligible pay multiplied by the participant’s credited years of service in excess

of 35 years.

MARTIN MARIETTA 69