Page 73 - Martin Marietta - 2021 Proxy Statement

P. 73

EXECUTIVE COMPENSATION / OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

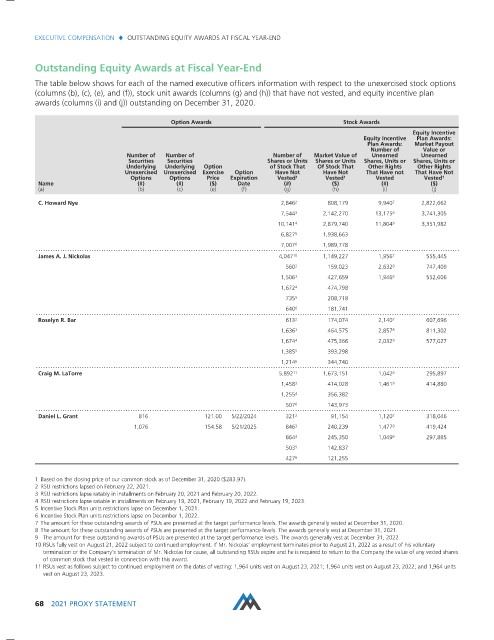

Outstanding Equity Awards at Fiscal Year-End

The table below shows for each of the named executive officers information with respect to the unexercised stock options

(columns (b), (c), (e), and (f)), stock unit awards (columns (g) and (h)) that have not vested, and equity incentive plan

awards (columns (i) and (j)) outstanding on December 31, 2020.

Option Awards Stock Awards

Equity Incentive

Equity Incentive Plan Awards:

Plan Awards: Market Payout

Number of Value or

Number of Number of Number of Market Value of Unearned Unearned

Securities Securities Shares or Units Shares or Units Shares, Units or Shares, Units or

Underlying Underlying Option of Stock That Of Stock That Other Rights Other Rights

Unexercised Unexercised Exercise Option Have Not Have Not That Have not That Have Not

Options Options Price Expiration Vested 1 Vested 1 Vested Vested 1

Name (#) (#) ($) Date (#) ($) (#) ($)

(a) (b) (c) (e) (f) (g) (h) (i) (j)

C. Howard Nye 2,846 2 808,179 9,940 7 2,822,662

7,544 3 2,142,270 13,175 8 3,741,305

10,141 4 2,879,740 11,804 9 3,351,982

6,827 5 1,938,663

7,007 6 1,989,778

James A. J. Nickolas 4,047 10 1,149,227 1,956 7 555,445

560 2 159,023 2,632 8 747,409

1,506 3 427,659 1,946 9 552,606

1,672 4 474,798

735 5 208,718

640 6 181,741

Roselyn R. Bar 613 2 174,074 2,140 7 607,696

1,636 3 464,575 2,857 8 811,302

1,674 4 475,366 2,032 9 577,027

1,385 5 393,298

1,214 6 344,740

Craig M. LaTorre 5,892 11 1,673,151 1,042 8 295,897

1,458 3 414,028 1,461 9 414,880

1,255 4 356,382

507 6 143,973

Daniel L. Grant 816 121.00 5/22/2024 321 2 91,154 1,120 7 318,046

1,076 154.58 5/21/2025 846 3 240,239 1,477 8 419,424

864 4 245,350 1,049 9 297,885

503 5 142,837

427 6 121,255

1 Based on the closing price of our common stock as of December 31, 2020 ($283.97).

2 RSU restrictions lapsed on February 22, 2021.

3 RSU restrictions lapse ratably in installments on February 20, 2021 and February 20, 2022.

4 RSU restrictions lapse ratable in installments on February 19, 2021, February 19, 2022 and February 19, 2023.

5 Incentive Stock Plan units restrictions lapse on December 1, 2021.

6 Incentive Stock Plan units restrictions lapse on December 1, 2022.

7 The amount for these outstanding awards of PSUs are presented at the target performance levels. The awards generally vested at December 31, 2020.

8 The amount for these outstanding awards of PSUs are presented at the target performance levels. The awards generally vest at December 31, 2021.

9 The amount for these outstanding awards of PSUs are presented at the target performance levels. The awards generally vest at December 31, 2022.

10 RSUs fully vest on August 21, 2022 subject to continued employment. If Mr. Nickolas’ employment terminates prior to August 21, 2022 as a result of his voluntary

termination or the Company’s termination of Mr. Nickolas for cause, all outstanding RSUs expire and he is required to return to the Company the value of any vested shares

of common stock that vested in connection with this award.

11 RSUs vest as follows subject to continued employment on the dates of vesting: 1,964 units vest on August 23, 2021; 1,964 units vest on August 23, 2022; and 1,964 units

vest on August 23, 2023.

68 2021 PROXY STATEMENT