Page 79 - Martin Marietta - 2023 Proxy Statement

P. 79

GRANTS OF PLAN-BASED AWARDS / EXECUTIVE COMPENSATION

4 The amounts in column (g) for 2022 reflect the cash paid to the named individuals earned in 2022 and paid in 2023 under annual incentive arrangements discussed in

further detail beginning on page 59 under the headings “2022 Annual Cash Incentive Goals and Results” and “2022 Actual Incentive Cash Earned,” and not deferred

pursuant to Martin Marietta’s Incentive Stock Plan, which is discussed in further detail on page 61 under the heading “Annual Incentive Feature: Stock Purchase Plan.”

5 The amounts in column (h) reflect the aggregate increase in the actuarial present value of the named executive officer’s accumulated benefits during 2022, 2021 and 2020,

respectively, under all defined benefit retirement plans established by Martin Marietta determined using interest rate and mortality rate assumptions consistent with those

used in Martin Marietta’s financial statements and include amounts which the named executive officer may not currently be entitled to receive because such amounts are

not vested.

6 The amount shown in column (i) for 2022 reflects for each named executive officer: matching contributions allocated by Martin Marietta to each of the named executive

officers pursuant to the Savings and Investment Plan, which is more fully described on pages under the heading “Retirement and Other Benefits” in the following amounts:

Mr. Nye, $10,675; Mr. Nickolas, $9,000; Ms. Bar, $7,368; Mr. LaTorre, $7,386; and Mr. Mohr, $10,675; the value attributable to life insurance benefits provided to the

named executive officers, which is more fully described on page 70 under the heading “Retirement and Other Benefits” in the following amounts: Mr. Nye, $15,444;

Mr. Nickolas, $5,382; Ms. Bar, $15,444; Mr. LaTorre, $3,883; and Mr. Mohr, $3,008; the value attributable to personal use of leased automobiles provided by Martin

Marietta in the following amounts: Mr. Nye, $10,662; Mr. Nickolas, $14,212; Ms. Bar, $15,349; Mr. LaTorre, $13,537; and Mr. Mohr, $3,986. These values are included as

compensation on the W-2 of named executive officers who receive such benefits. Each such named executive officer is responsible for paying income tax on such amount.

The amounts in column (i) also reflect the dollar value of dividend equivalents on units credited under the equity awards as computed for financial statement reporting

purposes for each fiscal year ended December 31, 2022, 2021 and 2020 in accordance with FASB ASC Topic 718.

7 Mr. Mohr was not a named executive officer for purposes of the Summary Compensation Table in 2020.

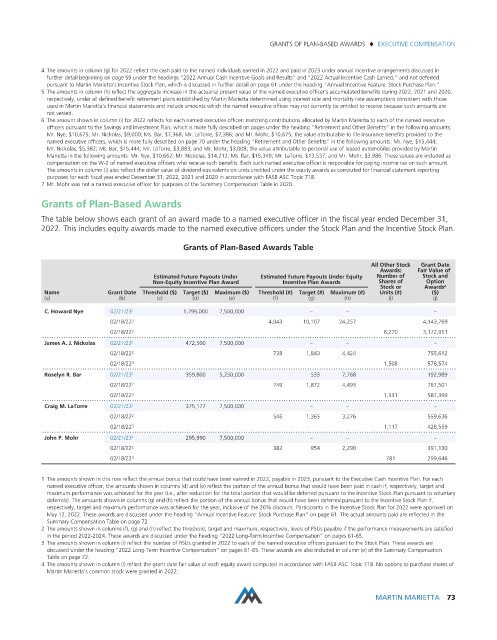

Grants of Plan-Based Awards

The table below shows each grant of an award made to a named executive officer in the fiscal year ended December 31,

2022. This includes equity awards made to the named executive officers under the Stock Plan and the Incentive Stock Plan.

Grants of Plan-Based Awards Table

All Other Stock Grant Date

Awards: Fair Value of

Estimated Future Payouts Under Estimated Future Payouts Under Equity Number of Stock and

Non-Equity Incentive Plan Award Incentive Plan Awards Shares of Option

Stock or Awards 4

Name Grant Date Threshold ($) Target ($) Maximum ($) Threshold (#) Target (#) Maximum (#) Units (#) ($)

(a) (b) (c) (d) (e) (f) (g) (h) (i) (j)

C. Howard Nye 02/21/23 1 1,799,000 7,500,000 – – –

02/18/22 2 4,043 10,107 24,257 4,143,769

02/18/22 3 8,270 3,172,951

James A. J. Nickolas 02/21/23 1 472,500 7,500,000 – – –

02/18/22 2 738 1,843 4,424 755,612

02/18/22 3 1,508 578,574

Roselyn R. Bar 02/21/23 1 359,800 5,250,000 533 7,768 192,989

02/18/22 2 749 1,872 4,493 767,501

02/18/22 3 1,531 587,399

CraigM. LaTorre 02/21/23 1 375,177 7,500,000 – – –

02/18/22 2 546 1,365 3,276 559,636

02/18/22 3 1,117 428,559

John P. Mohr 02/21/23 1 295,890 7,500,000 – – –

02/18/22 2 382 954 2,290 391,130

02/18/22 3 781 299,646

1 The amounts shown in this row reflect the annual bonus that could have been earned in 2022, payable in 2023, pursuant to the Executive Cash Incentive Plan. For each

named executive officer, the amounts shown in columns (d) and (e) reflect the portion of the annual bonus that would have been paid in cash if, respectively, target and

maximum performance was achieved for the year (i.e., after reduction for the total portion that would be deferred pursuant to the Incentive Stock Plan pursuant to voluntary

deferrals). The amounts shown in columns (g) and (h) reflect the portion of the annual bonus that would have been deferred pursuant to the Incentive Stock Plan if,

respectively, target and maximum performance was achieved for the year, inclusive of the 20% discount. Participants in the Incentive Stock Plan for 2022 were approved on

May 12, 2022. These awards are discussed under the heading “Annual Incentive Feature: Stock Purchase Plan” on page 61. The actual amounts paid are reflected in the

Summary Compensation Table on page 72.

2 The amounts shown in columns (f), (g) and (h) reflect the threshold, target and maximum, respectively, levels of PSUs payable if the performance measurements are satisfied

in the period 2022-2024. These awards are discussed under the heading “2022 Long-Term Incentive Compensation” on pages 61-65.

3 The amounts shown in column (i) reflect the number of RSUs granted in 2022 to each of the named executive officers pursuant to the Stock Plan. These awards are

discussed under the heading “2022 Long-Term Incentive Compensation” on pages 61-65. These awards are also included in column (e) of the Summary Compensation

Table on page 72.

4 The amounts shown in column (l) reflect the grant date fair value of each equity award computed in accordance with FASB ASC Topic 718. No options to purchase shares of

Martin Marietta’s common stock were granted in 2022.

MARTIN MARIETTA 73