Page 148 - Martin Marietta - 2023 Proxy Statement

P. 148

NOTES TO FINANCIAL STATEMENTS (Continued)

Pursuant to authority granted byits Board of Directors, the Company can repurchase up to 20.0 million shares of common stock.

During 2022 and 2020, the Company repurchased 0.4 million and 0.2 million shares of common stock, respectively. The Company

made no share repurchases during 2021. Future share repurchases are at the discretion of management. At December 31, 2022,

13.1 million shares of common stock were remaining under the Company’s repurchase authorization.

Note O: Commitments and Contingencies

Legal and Administrative Proceedings. The Company is engaged in certain legal and administrative proceedings incidental to its

normal business activities. In the opinion of management and counsel, based upon currently‐available facts, the likelihood is

remote that the ultimate outcome of any litigation and other proceedings, including those pertaining to environmental matters

(see Note A), relating to the Company and its subsidiaries, will have a material adverse effect on the overall results of the

Company’s operations, its cash flows or its financial position.

Asset Retirement Obligations. The Company incurs reclamation and teardown costs as part of its mining and production processes.

Estimated future obligations are discounted to their present value and accreted to their projected future obligations via charges

to operating expenses. Additionally, the fixed assets recorded concurrently with the liabilities are depreciated over the period until

retirement activities are expected to occur. Total accretion and depreciation expenses for 2022, 2021 and 2020 were $15.5 million,

e

$11.9 million and $14.5 million, respectively, and are included in Other operating income, net, in the consolidated statements of

earnings.

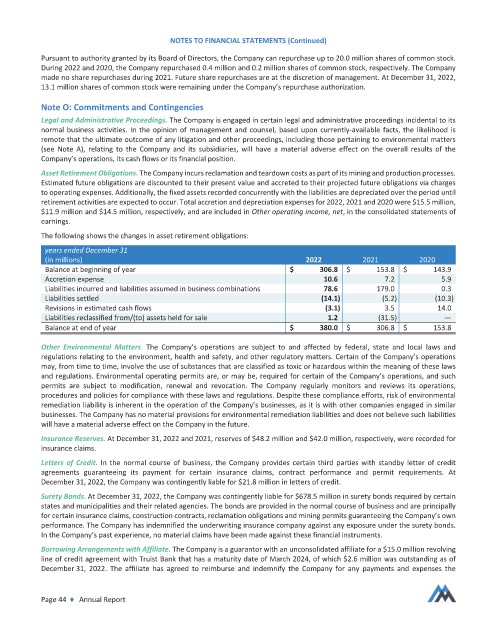

The following shows the changes in asset retirement obligations:

years ended December 31

(in millions) 2022 2021 2020

Balance at beginning of year $ 306.8 $ 153.8 $ 143.9

Accretion expense 10.6 7.2 5.9

Liabilities incurred and liabilities assumed in business combinations 78.6 179.0 0.3

Liabilities settled (14.1) (5.2) (10.3)

Revisions in estimated cash flows (3.1) 3.5 14.0

Liabilities reclassified from/(to) assets held for sale 1.2 (31.5) —

Balance at end of year $ 380.0 $ 306.8 $ 153.8

Other Environmental Matters. The Company’s operations are subject to and affected by federal, state and local laws and

regulations relating to the environment, health and safety, and other regulatory matters. Certain of the Company’s operations

may, from time to time, involve the use of substances that are classified as toxic or hazardous within the meaning of these laws

and regulations. Environmental operating permits are, or may be, required for certain of the Company’s operations, and such

permits are subject to modification, renewal and revocation. The Company regularly monitors and reviews its operations,

procedures and policies for compliance with these laws and regulations. Despite these compliance efforts, risk of environmental

remediation liability is inherent in the operation of the Company’s businesses, as it is with other companies engaged in similar

businesses. The Company has no material provisions for environmental remediation liabilities and does not believe such liabilities

will have a material adverse effect on the Company in the future.

Insurance Reserves. t December 31, 2022 and 2021, reserves of $48.2 million and $42.0 million, respectively, were recorded for

insurance claims.

Letters of Credit. In the normal course of business, the Company provides certain third parties with standby letter of credit

agreements guaranteeing its payment for certain insurance claims, contract performance and permit requirements. At

December 31, 2022, the Company was contingently liable for $21.8 million in letters of credit.

Surety Bonds. At December 31, 2022, the Company was contingently liable for $678.5 million in surety bonds required by certain

states and municipalities and their related agencies. The bonds are provided in the normal course of business and are principally

for certain insurance claims, construction contracts, reclamation obligations and mining permits guaranteeing the Company’s own

performance. The Company has indemnified the underwriting insurance company against any exposure under the surety bonds.

In the Company’s past experience, no material claims have been made against these financial instruments.

Borrowing Arrangements with Affiliate. The Company is a guarantor with an unconsolidated affiliate for a $15.0 million revolving

line of credit agreement with Truist Bank that has a maturity date of March 2024, of which $2.6 million was outstanding as of

December 31, 2022. The affiliate has agreed to reimburse and indemnify the Companyfor any payments and expenses the

Page 44 ♦ Annual Report