Page 156 - Martin Marietta - 2024 Proxy Statement

P. 156

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued)

Generally, the Company’s building materials are both sourced and sold locally. As a result, geography is critically important when

assessing market attractiveness and growth opportunities. Attractive geographies generally exhibit (a) population growth and/or

high population density, both ofwhich are drivers of heavy‐side building materials consumption; (b) business and employment

diversity, drivers of greater economic stability; and (c) a superior state financial position, a driver of public infrastructure

investment.

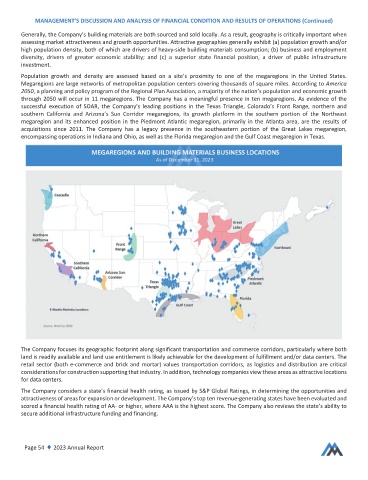

Population growth and density are assessed based on a site’s proximity to one of the megaregions in the United States.

Megaregions are large networks of metropolitan population centers covering thousands of square miles. According to America

2050, a planning and policy program of the Regional Plan Association, a majority of the nation’s population and economic growth

through 2050 will occur in 11 megaregions. The Company has a meaningful presence in ten megaregions. As evidence of the

successful execution of SOAR, the Company’s leading positions in the Texas Triangle, Colorado’s Front Range, northern and

southern California and Arizona’s Sun Corridor megaregions, its growth platform in the southern portion of the Northeast

megaregion and its enhanced position in the Piedmont Atlantic megaregion, primarily in the Atlanta area, are the results of

acquisitions since 2011. The Company has a legacy presence in the southeastern portion of the Great Lakes megaregion,

encompassing operations in Indiana and Ohio, as well as the Florida megaregion and the GulfCoast megaregion in Texas.

The Company focuses its geographic footprint along significant transportation and commerce corridors, particularly where both

land is readily available and land use entitlement is likely achievable for the development offulfillment and/or data centers. The

retail sector (both e‐commerce and brick and mortar) values transportation corridors, as logistics and distribution are critical

considerations for construction supporting that industry. In addition, technology companies view these areas as attractive locations

for data centers.

The Company considers a state’s financial health rating, as issued by S&P Global Ratings, in determining the opportunities and

attractiveness of areas for expansion or development. The Company’s top ten revenue‐generating states have been evaluated and

scored a financial health rating of AA‐ or higher, where AAA is the highest score. The Company also reviews the state’s ability to

secure additional infrastructure funding and financing.

Page 54 ♦ 2023 Annual Report