Page 140 - Martin Marietta - 2024 Proxy Statement

P. 140

NOTES TO FINANCIAL STATEMENTS (Continued)

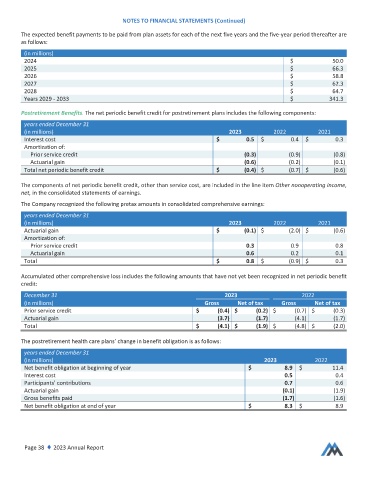

The expected benefit payments to be paid from plan assets for each of the next five years and the five‐year period thereafter are

as follows:

(in millions)

2024 $ 50.0

2025 $ 66.3

2026 $ 58.8

2027 $ 62.3

2028 $ 64.7

Years 2029 ‐ 2033 $ 341.3

Postretirement Benefits. The net periodic benefit credit for postretirement plans includes the following components:

years ended December 31

(in millions) 2023 2022 2021

terest cost $ 0.5 $ 0.4 $ 0.3

Amortization of:

ior service credit (0.3) (0.9) (0.8)

Actuarial gain (0.6) (0.2) (0.1)

Total net periodic benefit credit $ (0.4) $ (0.7) $ (0.6)

e

The components of net periodic benefit credit, other than service cost, are included in the line item Other nonoperating income,

net, in the consolidated statements of earnings.

The Company recognized the following pretax amounts in consolidated comprehensive earnings:

years ended December 31

(in millions) 2023 2022 2021

tuarial gain $ (0.1) $ (2.0) $ (0.6)

Amortization of:

ior service credit 0.3 0.9 0.8

Actuarial gain 0.6 0.2 0.1

Total $ 0.8 $ (0.9) $ 0.3

Accumulated other comprehensive loss includes the following amounts that have not yet been recognized in net periodic benefit

credit:

December 31 2023 2022

(in millions) Gross Net of tax Gross Net of tax

Prior service credit $ (0.4) $ (0.2) $ (0.7) $ (0.3)

Actuarial gain (3.7) (1.7) (4.1) (1.7)

Total $ (4.1) $ (1.9) $ (4.8) $ (2.0)

The postretirement health care plans’ change in benefit obligation is as follows:

years ended December 31

(in millions) 2023 2022

Net benefit obligation at beginning of year $ 8.9 $ 11.4

Interest cost 0.5 0.4

Participants’ contributions 0.7 0.6

Actuarial gain (0.1) (1.9)

Gross benefits paid (1.7) (1.6)

Net benefit obligation at end of year $ 8.3 $ 8.9

ge 38 ♦ 2023 Annual Report