Page 105 - Martin Marietta - 2024 Proxy Statement

P. 105

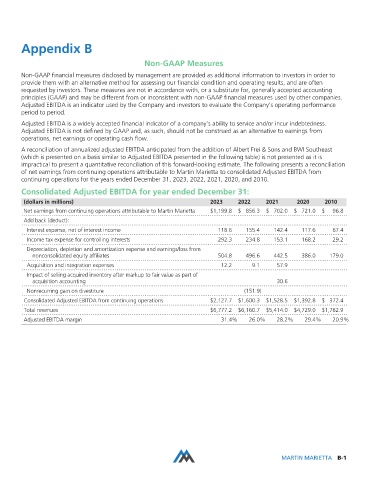

Appendix B

Non-GAAP Measures

Non-GAAP financial measures disclosed by management are provided as additional information to investors in order to

provide them with an alternative method for assessing our financial condition and operating results, and are often

requested by investors. These measures are not in accordance with, or a substitute for, generally accepted accounting

principles (GAAP) and may be different from or inconsistent with non-GAAP financial measures used by other companies.

Adjusted EBITDA is an indicator used by the Company and investors to evaluate the Company’s operating performance

period to period.

Adjusted EBITDA is a widely accepted financial indicator of a company’s ability to service and/or incur indebtedness.

Adjusted EBITDA is not defined by GAAP and, as such, should not be construed as an alternative to earnings from

operations, net earnings or operating cash flow.

A reconciliation of annualized adjusted EBITDA anticipated from the addition of Albert Frei & Sons and BWI Southeast

(which is presented on a basis similar to Adjusted EBITDA presented in the following table) is not presented as it is

impractical to present a quantitative reconciliation of this forward-looking estimate. The following presents a reconciliation

of net earnings from continuing operations attributable to Martin Marietta to consolidated Adjusted EBITDA from

continuing operations for the years ended December 31, 2023, 2022, 2021, 2020, and 2010.

Consolidated Adjusted EBITDA for year ended December 31:

(dollars in millions) 2023 2022 2021 2020 2010

Net earnings from continuing operations attributable to Martin Marietta $1,199.8 $ 856.3 $ 702.0 $ 721.0 $ 96.8

Add back (deduct):

Interest expense, net of interest income 118.6 155.4 142.4 117.6 67.4

Income tax expense for controlling interests 292.3 234.8 153.1 168.2 29.2

Depreciation, depletion and amortization expense and earnings/loss from

nonconsolidated equity affiliates 504.8 496.6 442.5 386.0 179.0

Acquisition and integration expenses 12.2 9.1 57.9

Impact of selling acquired inventory after markup to fair value as part of

acquisition accounting 30.6

Nonrecurring gain on divestiture (151.9)

Consolidated Adjusted EBITDA from continuing operations $2,127.7 $1,600.3 $1,528.5 $1,392.8 $ 372.4

Total revenues $6,777.2 $6,160.7 $5,414.0 $4,729.0 $1,782.9

Adjusted EBITDA margin 31.4% 26.0% 28.2% 29.4% 20.9%

MARTIN MARIETTA B-1