Page 91 - Martin Marietta - 2023 Proxy Statement

P. 91

/ PAY VERSUS PERFORMANCE

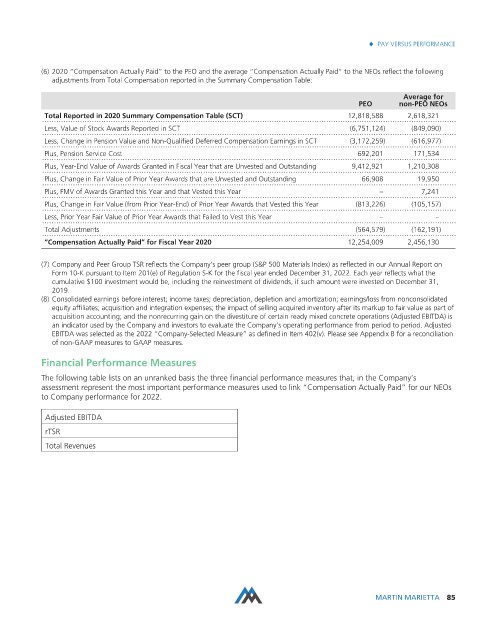

(6) 2020 “Compensation Actually Paid” to the PEO and the average “Compensation Actually Paid” to the NEOs reflect the following

adjustments from Total Compensation reported in the Summary Compensation Table:

Average for

PEO non-PEO NEOs

Total Reported in 2020 Summary Compensation Table (SCT) 12,818,588 2,618,321

Less, Value of Stock Awards Reported in SCT (6,751,124) (849,090)

Less, Change in Pension Value and Non-Qualified Deferred Compensation Earnings in SCT (3,172,259) (616,977)

Plus, Pension Service Cost 692,201 171,534

Plus, Year-End Value of Awards Granted in Fiscal Year that are Unvested and Outstanding 9,412,921 1,210,308

Plus, Change in Fair Value of Prior Year Awards that are Unvested and Outstanding 66,908 19,950

Plus, FMV of Awards Granted this Year and that Vested this Year – 7,241

Plus, Change in Fair Value (from Prior Year-End) of Prior Year Awards that Vested this Year (813,226) (105,157)

Less, Prior Year Fair Value of Prior Year Awards that Failed to Vest this Year – –

Total Adjustments (564,579) (162,191)

“Compensation Actually Paid” for Fiscal Year 2020 12,254,009 2,456,130

(7) Company and Peer Group TSR reflects the Company’s peer group (S&P 500 Materials Index) as reflected in our Annual Report on

Form 10-K pursuant to Item 201(e) of Regulation S-K for the fiscal year ended December 31, 2022. Each year reflects what the

cumulative $100 investment would be, including the reinvestment of dividends, if such amount were invested on December 31,

2019.

(8) Consolidated earnings before interest; income taxes; depreciation, depletion and amortization; earnings/loss from nonconsolidated

equity affiliates; acquisition and integration expenses; the impact of selling acquired inventory after its markup to fair value as part of

acquisition accounting; and the nonrecurring gain on the divestiture of certain ready mixed concrete operations (Adjusted EBITDA) is

an indicator used by the Company and investors to evaluate the Company’s operating performance from period to period. Adjusted

EBITDA was selected as the 2022 “Company-Selected Measure” as defined in Item 402(v). Please see Appendix B for a reconciliation

of non-GAAP measures to GAAP measures.

Financial Performance Measures

The following table lists on an unranked basis the three financial performance measures that, in the Company’s

assessment represent the most important performance measures used to link “Compensation Actually Paid” for our NEOs

to Company performance for 2022.

Adjusted EBITDA

rTSR

Total Revenues

MARTIN MARIETTA 85