Page 165 - Martin Marietta - 2023 Proxy Statement

P. 165

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Continued)

the Company’s first‐ and fourth‐quarter results, respectively, where warm and/or moderate temperatures in March and

November allow the construction season to start earlier and end later, respectively.

Excessive rainfall jeopardizes production efficiencies, shipments and profitability in all markets served by the Company. In

particular, the Company’s operations in the southeastern and GulfCoast regions of the United States and The Bahamas are at

risk for hurricane activityfrom June 1 through November 1, but most notably in August, September and October. The

Company’s California operations are at risk for wildfire activity and water use restrictions in severe drought conditions.

Increased intensity and frequency of extreme weather events have been linked to climate change, and further global warming

may increase the risk of adverse weather conditions.

Capital investment decisions driven by capital intensity of the Building Materials business and focus on

land

The Company’s organic capital program is designed to leverage construction market growth through investment in both

permanent and portable facilities at the Company’s operations. Over an economic cycle, the Company typically invests organic

capital at an annual level that approximates depreciation expense. At mid‐cycle and through cyclical peaks, organic capital

investment typically exceeds depreciation expense, as the Company supports current capacity needs and future growth.

Conversely, at a cyclical trough, the Company may reduce levels of capital investment. Regardless of cycle, the Company sets a

priority of investing capital to ensure safe, environmentally‐sound and efficient operations, as well as to provide the highest

quality of customer service and establish a foundation for future growth.

The Company is diligent in its focus on land opportunities, including potential new sites (greensites) and existing site expansion.

Land purchases are usually opportunistic and can include contiguous property around existing quarry locations. Such property

can serve as buffer property or additional mineral reserves, assuming regulatory hurdles can be cleared and the underlying

geology supports economical aggregates mining. In either instance, the acquisition of additional property around an existing

quarry typically allows the expansion of the quarryfootprint and an extension of quarry life.

Magnesia Specialties Business

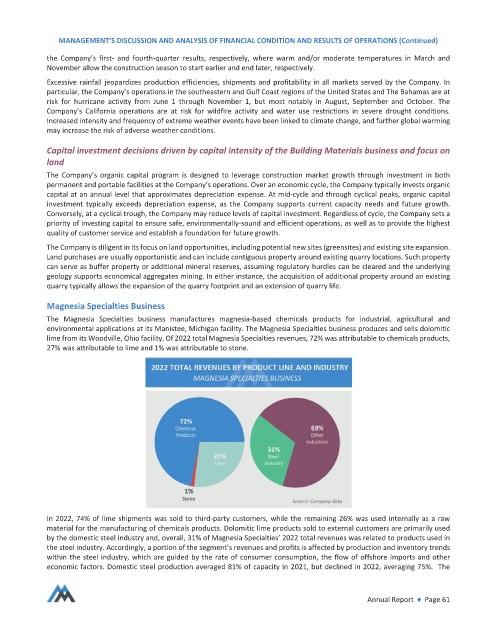

The Magnesia Specialties business manufactures magnesia‐based chemicals products for industrial, agricultural and

environmental applications at its Manistee, Michigan facility. The Magnesia Specialties business produces and sells dolomitic

lime from its Woodville, Ohio facility. Of 2022 total Magnesia Specialties revenues, 72% was attributable to chemicals products,

27% was attributable to lime and 1% was attributable to stone.

In 2022, 74% of lime shipments was sold to third‐party customers, while the remaining 26% was used internally as a raw

material for the manufacturing of chemicals products. Dolomitic lime products sold to external customers are primarily used

by the domestic steel industry and, overall, 31% of Magnesia Specialties’ 2022 total revenues was related to products used in

the steel industry. Accordingly, a portion of the segment’s revenues and profits is affected by production and inventory trends

within the steel industry, which are guided by the rate of consumer consumption, the flow of offshore imports and other

economic factors. Domestic steel production averaged 81% of capacity in 2021, but declined in 2022, averaging 75%. The

Annual Report ♦ Page 61