Page 90 - Martin Marietta - 2021 Proxy Statement

P. 90

APPENDIX B /

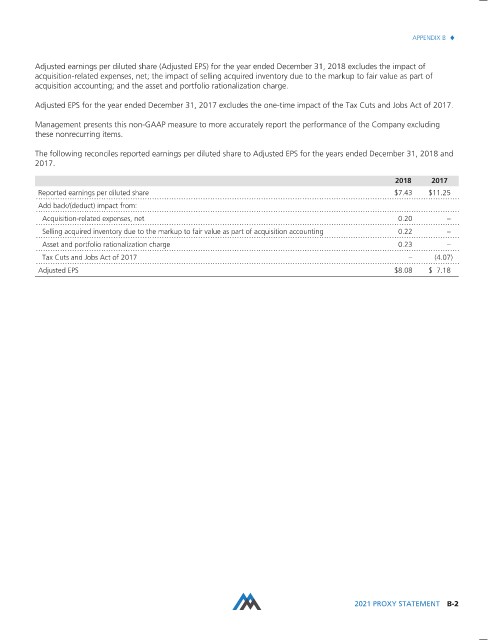

Adjusted earnings per diluted share (Adjusted EPS) for the year ended December 31, 2018 excludes the impact of

acquisition-related expenses, net; the impact of selling acquired inventory due to the markup to fair value as part of

acquisition accounting; and the asset and portfolio rationalization charge.

Adjusted EPS for the year ended December 31, 2017 excludes the one-time impact of the Tax Cuts and Jobs Act of 2017.

Management presents this non-GAAP measure to more accurately report the performance of the Company excluding

these nonrecurring items.

The following reconciles reported earnings per diluted share to Adjusted EPS for the years ended December 31, 2018 and

2017.

2018 2017

Reported earnings per diluted share $7.43 $11.25

Add back/(deduct) impact from:

Acquisition-related expenses, net 0.20 –

Selling acquired inventory due to the markup to fair value as part of acquisition accounting 0.22 –

Asset and portfolio rationalization charge 0.23 –

Tax Cuts and Jobs Act of 2017 – (4.07)

Adjusted EPS $8.08 $ 7.18

2021 PROXY STATEMENT B-2